Starting Sep 2, 2025, Bybit will implement a major update to the margin calculation algorithm for Perpetual and Expiry contracts. This update changes how Initial Margin (IM) and Maintenance Margin (MM) are calculated — shifting from using the Entry Price to using the Mark Price in certain margin modes. The goal is to better align margin calculations with real-time market conditions and more accurately reflect the actual risk of positions.

Key Adjustments

-

Cross Margin: IM and MM will be calculated based on the Mark Price instead of the Entry Price.

-

Isolated Margin: MM will be calculated using the Mark Price, while IM will continue to be based on the Entry Price. The liquidation price formula will be updated, but the value will remain fixed, consistent with the current experience.

-

Portfolio Margin: No adjustment.

-

Risk Limit: The risk limit tier will now adjust dynamically based on the real-time Mark Price and the combined value of positions and orders.

Updated Margin Calculation Logic

The following tables summarize how margin calculations will change across margin modes and contract types.

1. USDT/USDC Contracts — Isolated Margin Mode (One-Way + Hedge Modes)

|

|

Current (Based on Entry Price) |

New (Mark Price Introduced) |

|

Position Value |

USDT: Position Size × Average Entry Price |

Position Size × Mark Price |

|

Position IM |

USDT: (Position Size × Average Entry Price ÷ Leverage) + [Entry Price × Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

No change |

|

Position MM |

USDT: [(Position Size × Average Entry Price × MM Rate) − MM Deduction] + [Position Size × Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

USDT: [(Position Size × Mark Price × MM Rate) − MM Deduction] + [Position Size × Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate]

USDC: No change |

2. USDT/USDC Contracts — Cross Margin Mode (One-Way Mode)

|

|

Current (Based on Entry Price) |

New (Mark Price Introduced) |

|

Position Value |

Position Size × Average Entry Price |

Position Size × Mark Price |

|

Position IM |

(Position Size × Average Entry Price ÷ Leverage) + [Entry Price × Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

USDT: (Position Size × Mark Price ÷ Leverage) + [Entry Price × Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate]

USDC: No change |

|

Position MM |

[(Position Size × Average Entry Price × MM Rate) − MM Deduction] + [Position Size × Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

USDT: [(Position Size × Mark Price × MM Rate) − MM Deduction] + [Position Size × Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate]

USDC: No change |

3. USDT/USDC Contracts − Cross Margin Mode (Hedge Mode)

|

|

Current (Based on Entry Price) |

New (Mark Price Introduced) |

|

Position Value |

Position Size × Average Entry Price |

Position Size × Mark Price |

|

Position IM |

Position with a larger position size: (Average Entry Price × Hedged Position Size ÷ Leverage) + [Average Entry Price × Hedged Position Size (1 ± 1 ÷ Leverage) × Taker Fee Rate × 2] + (Average Entry Price × Net Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate)

When fully hedged, net position size = 0

Position with a smaller position size: Average Entry Price × Hedged Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate × 2 |

USDT: Position with a larger position size: (Mark Price × Hedged Position Size ÷ Leverage) + [Entry Price × Hedged Position Size (1 ± 1 ÷ Leverage) × Taker Fee Rate × 2] + (Entry Price × Net Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate)

When fully hedged, net position size = 0

Position with a smaller position size: No change

USDC: No Change |

|

Position MM |

Position with a larger position size: [(Average Entry Price × Net Position Size × MM Rate) − MM Deduction] + [Average Entry Price × Hedge Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate × 2] + [Average Entry Price × Net Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate]

When fully hedged, net position size = 0

Position with a lower position size: Average Entry Price × Hedged Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate × 2 |

USDT: Position with a larger position size: [(Mark Price × Net Position Size × MM Rate) − MM Deduction] + [Entry Price × Hedge Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate × 2] + [Entry Price × Net Position Size × (1 ± 1 ÷ Leverage) × Taker Fee Rate]

When fully hedged, net position size = 0

Position with a lower position size: No change

USDC: No Change |

4. Inverse Contracts — Isolated Margin Mode (Only One-Way Mode)

|

|

Current (Based on Entry Price) |

New (Mark Price Introduced) |

|

Position Value |

Position Size ÷ Entry Price |

Position Size ÷ Mark Price |

|

Position IM |

[(Position Size ÷ Entry Price) ÷ Leverage] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

No change |

|

Position MM |

[(Position Size ÷ Entry Price × MM Rate) − MM Deduction] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

[(Position Size ÷ Mark Price × MM Rate) − MM Deduction] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

5. Inverse Contracts — Cross Margin Mode (Only One-Way Mode)

|

|

Current (Based on Entry Price) |

New (Mark Price Introduced) |

|

Position Value |

Position Size ÷ Entry Price |

Position Size ÷ Mark Price |

|

Position IM |

[(Position Size ÷ Entry Price) ÷ Leverage] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

[(Position Size ÷ Mark Price) ÷ Leverage] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

|

Position MM |

[(Position Size ÷ Entry Price × MM Rate) − MM Deduction] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

[(Position Size ÷ Mark Price × MM Rate) − MM Deduction] + [Position Size ÷ Entry Price × (1 ± 1 ÷ Leverage) × Taker Fee Rate] |

Example: Impact Comparison

Let's examine the difference in margin requirements using USDT Cross Margin mode in a falling market scenario.

Position Setup:

-

Symbol: BTCUSDT

-

Side: Long

-

Size: 2 contracts

-

Entry Price: 94,694.80

-

Leverage: 10x

-

MM Rate: 0.5%

-

Taker Fee Rate: 0.055%

-

Wallet Balance: 20,000 USDT

-

Collateral Value Ratio: 0.99

If the Mark Price drops to 85,315.15, the position details, account IMR and MMR are as follows:

Based on the old calculation (using Entry Price):

-

IM = (94,694.80 × 2 ÷ 10) + (94,694.80 × 2 × (1 − 1 ÷ 10) × 0.00055) = 19,032.71

-

MM = (94,694.80 × 2 × 0.005) + (94,694.80 × 2 × (1 − 1 ÷ 10) × 0.00055) = 1,040.70

-

Unrealized PnL = (85,315.15 − 94,694.80) × 2 = -18,759.30

-

Margin Balance = 20,000 × 0.99 − 18,759.30 = 1,040.70

-

IMR = 19,032.71 ÷ 1,040.70 = 1,828.84%

-

MMR = 1,040.70 ÷ 1,040.70 = 100%

Based on the new calculation (using Mark Price):

-

IM = (85,315.15 × 2 ÷ 10) + (94,694.80 × 2 × (1 − 1 ÷ 10) × 0.00055) = 17,156.77

-

MM = (85,315.15 × 2 × 0.005) + (94,694.80 × 2 × (1 − 1 ÷ 10) × 0.00055) = 946.90

-

Other values remain unchanged.

-

IMR = 17,156.77 ÷ 1,040.70 = 1,648.59%

-

MMR = 946.90 ÷ 1,040.70 = 90.99%

Conclusion:

In this scenario, the new logic results in lower IM and MM, which delays liquidation and improves capital efficiency during adverse market movements.

Overall User Impact Summary

|

Contract Type |

Margin Mode |

Direction |

Market Trend |

Impact After the New Algorithm Launch |

|

USDT/USDC Contracts |

Cross Margin |

Long |

Up |

The increased Initial Margin will lock more unrealized profit in the position, reducing the amount of unrealized profit available for opening new positions compared to the old logic. |

|

Down |

Liquidation will be triggered later. | |||

|

Short |

Up |

Liquidation may be triggered earlier. | ||

|

Down |

The decreased Initial Margin will lock less unrealized profit in the position, increasing the amount of unrealized profit available for opening new positions compared to the old logic. | |||

|

Isolated Margin |

Long |

Up |

No impact | |

|

Down |

Liquidation will be triggered later. | |||

|

Short |

Up |

Liquidation may be triggered earlier. | ||

|

Down |

No impact | |||

|

Inverse Contracts |

Cross Margin |

Long |

Up |

The decreased Initial Margin will lock less unrealized profit in the position, increasing the amount of unrealized profit available for opening new positions compared to the old logic. |

|

Down |

Liquidation may be triggered earlier. | |||

|

Short |

Up |

Liquidation will be triggered later. | ||

|

Down |

The increased Initial Margin will lock more unrealized profit in the position, reducing the amount of unrealized profit available for opening new positions compared to the old logic. | |||

|

Isolated Margin |

Long |

Up |

No impact | |

|

Down |

Liquidation may be triggered earlier. | |||

|

Short |

Up |

Liquidation will be triggered later. | ||

|

Down |

No impact |

Impact on Risk Limit Tiers

Under the old logic, your risk limit tier only changed when you opened or closed positions or orders.

With the new logic, your tier will change automatically based on the real-time Mark Price. As the Mark Price moves, your position value may increase or decrease, which can push your position into a different tier. This triggers a real-time recalculation of your required Maintenance Margin.

In fast-moving markets, this may lead to sudden tier upgrades and higher margin requirements — potentially causing immediate liquidation if your margin balance isn't sufficient. We recommend closely monitoring your exposure and managing your risk proactively.

Isolated Margin: New Liquidation Price Calculation

|

|

Old Formula |

New Formula |

|

USDT/USDC Contract — Long |

Entry Price − [(IM − MM) ÷ Position Size] − (Extra Margin Added ÷ Position Size) |

[(Entry Price × Position Size) − (Entry Price × Position Size ÷ Leverage) − (Extra Margin Added ÷ ( 1 − Taker Fee Rate)) − MM Deduction] ÷ [Position Size − (Position Size × MM Rate)] |

|

USDT/USDC Contract — Short |

Entry Price + [(IM — MM) ÷ Position Size] + (Extra Margin Added ÷ Position Size) |

[(Entry Price × Position Size) + (Entry Price × Position Size ÷ Leverage) + (Extra Margin Added ÷ ( 1 + Taker Fee Rate)) + MM Deduction] ÷ [Position Size + (Position Size × MM Rate)] |

|

Inverse Contract — Long |

Position Size ÷ [Position Value + (IM − MM)] − (Extra Margin Added ÷ Position Size) |

[Position Size × (MM Rate + 1)] ÷ [(Position Size ÷ Entry Price) + (Position Size ÷ Entry Price ÷ Leverage) + (Extra Margin Added ÷ ( 1 + Taker Fee Rate)) + MM Deduction] |

|

Inverse Contract — Short |

Position Size ÷ [Position Value − (IM − MM)] + (Extra Margin Added ÷ Position Size) |

[Position Size × (1 − MM Rate)] ÷ [(Position Size ÷ Entry Price) − (Position Size ÷ Entry Price ÷ Leverage) − (Extra Margin Added ÷ ( 1 − Taker Fee Rate)) − MM Deduction] |

How to View Both Margin Logics on the Trading Page

The old logic is currently still used for margin calculations. Until the new calculation logic is gradually rolled out starting Sep 2, 2025, users will be able to view both the old and new margin logic. This allows you to better understand the risk level of your account and positions under the new calculation logic and manage risk in advance.

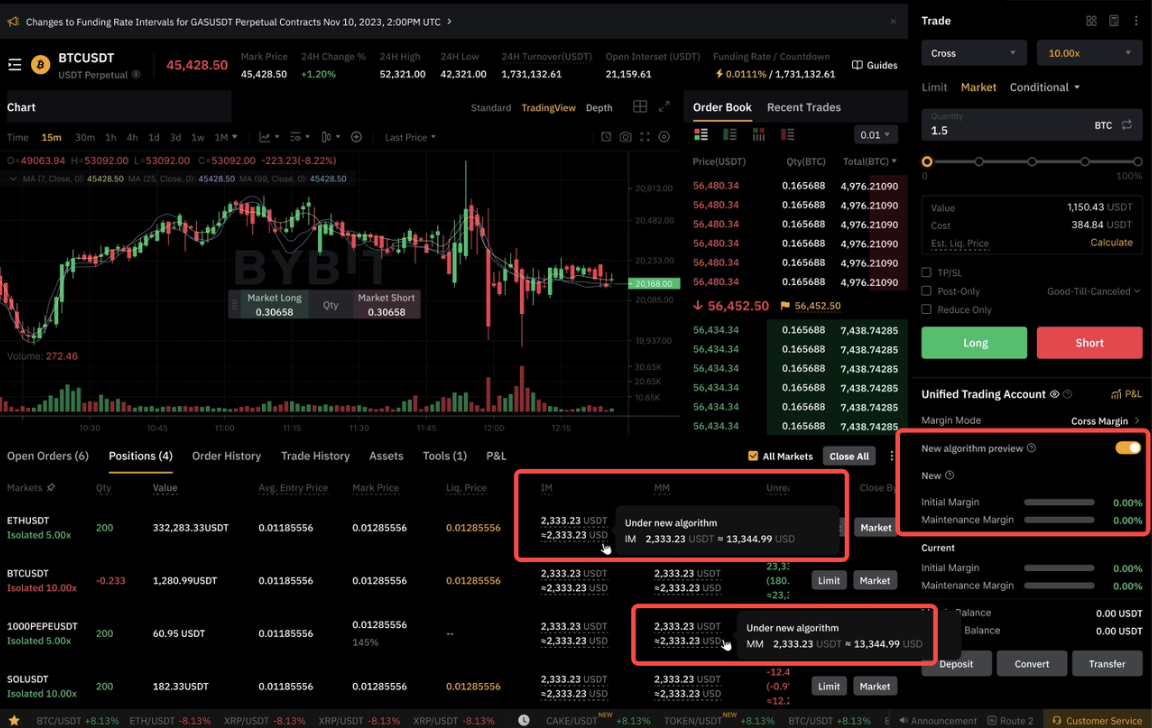

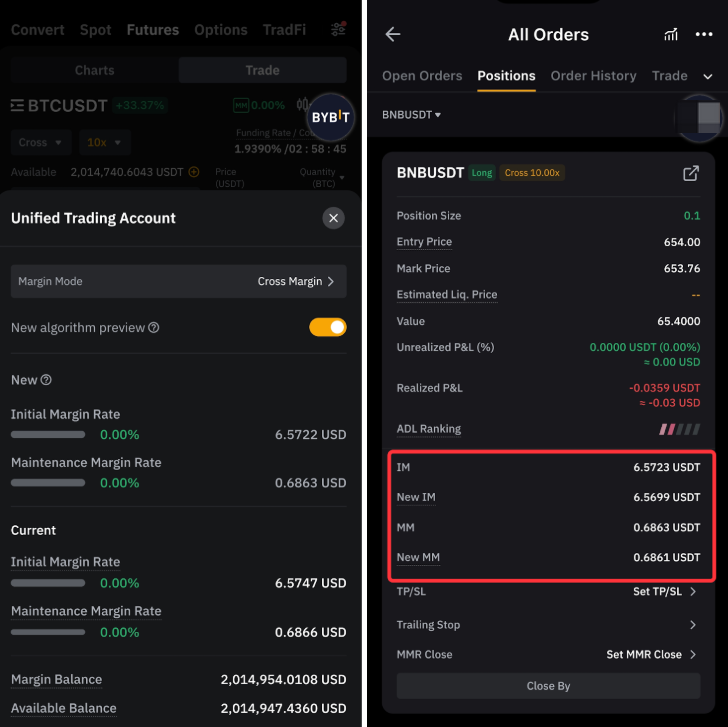

Cross Margin Mode

The new IMR and MMR appear in the account area, while position-level IM and MM are shown in the position area.

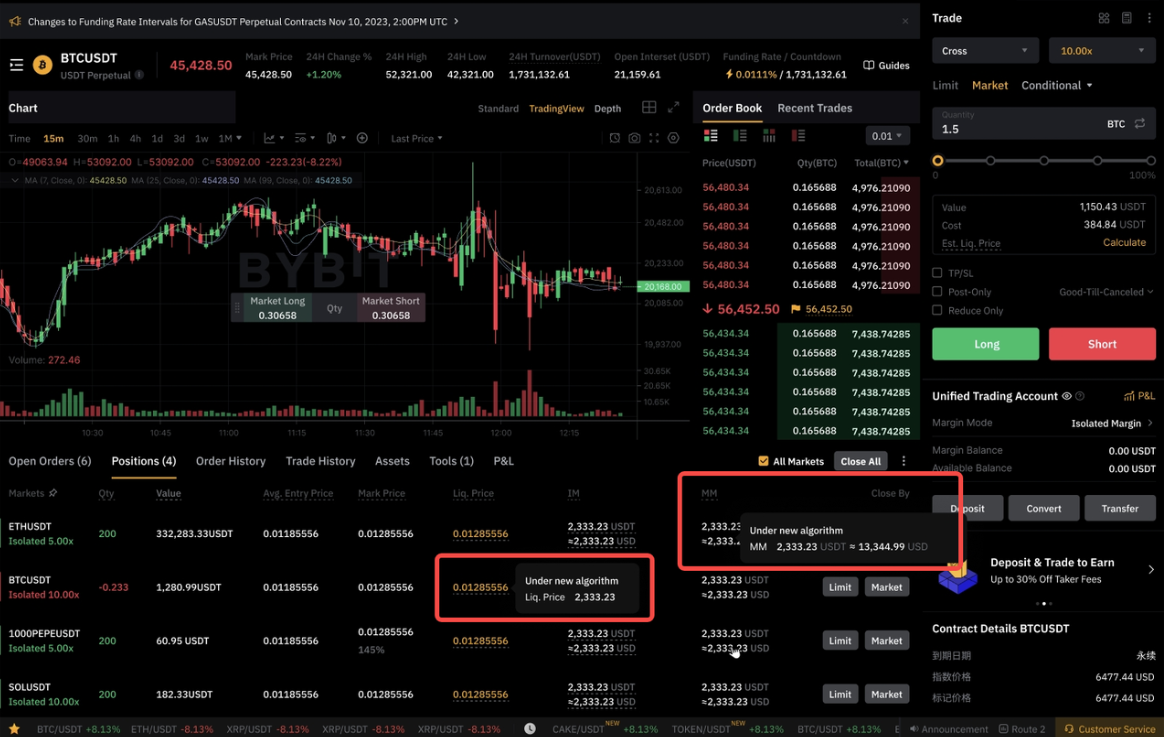

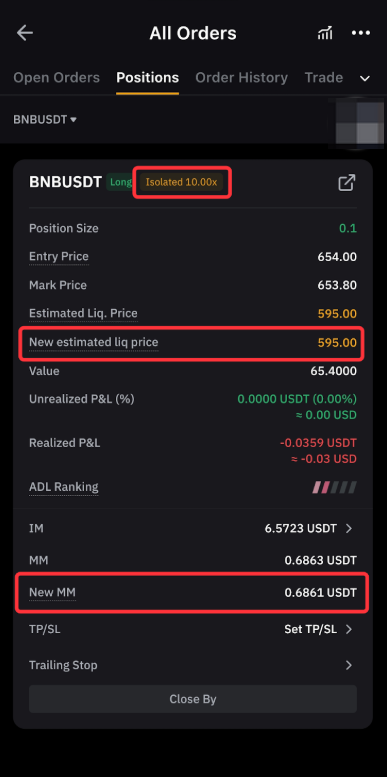

Isolated Margin Mode

The position-level liquidation price and MM (based on Mark Price) appear in the position area.

Frequently Asked Questions

How will this affect my positions?

You can preview the new margin calculation logic now, but the old logic will remain in effect until Sep 2, 2025. Refer to the account risk calculated under the new logic to proactively assess and manage your risk.

Why is my Maintenance Margin Rate (MMR) over 100% under the new algorithm?

This does not affect your positions yet. However, it signals potential liquidation risk once the new logic takes effect. We strongly recommend reviewing the changes and adjusting your positions accordingly to reduce exposure.

Why are IM and MM increasing under the new algorithm, even though I'm in profit?

IM and MM are now calculated based on the Mark Price. As the price rises, your position value increases, which in turn raises the margin requirement. However, this doesn't increase your overall account risk since your unrealized profit offsets the rise in the required margin.

Can I choose to stick with the old algorithm?

Unfortunately, no. To ensure consistency and fairness, the new margin algorithm will be gradually rolled out to all users starting Sep 2, 2025.

Are there new risks I should watch for after the new algorithm is implemented?

Yes. Since risk limit tiers now adjust dynamically with the Mark Price, a sudden price movement may raise your risk tier and MM requirement, potentially triggering liquidation in extreme conditions. Please manage your exposure accordingly.