Discount Buy is an advanced earn product that allows you to deploy your funds efficiently in any market condition. You may buy crypto at a discounted price. Even if the purchase is not triggered, your principal will be returned along with interest.

Discount Buy is suitable for users looking to buy crypto at a more favorable price while managing potential risks. For MNT products, MNT will always be purchased at the preset Purchase Price at maturity, regardless of market movement. The higher the market price, the greater the discount advantage and potential return.

Understanding Key Terms

|

Purchase Price |

The preset price at which the target asset will be purchased on the settlement date. |

|

Settlement Price |

The price of the target asset at the time of settlement. |

|

Knockout Price |

A price calculated by the system to determine whether the token will be purchased or the final principal and interest will be returned. (Not applicable to MNT products.) |

|

Knockout APR |

The annual percentage rate (APR) paid out in USDT if the Knockout Price is reached upon settlement. (Not applicable to MNT products.) |

How It Works

Non-MNT products

You need to invest a certain principal to subscribe to a Discount Buy plan. At maturity, there are two possible scenarios:

|

Scenarios |

Conditions |

Outcome at Settlement |

|

Buy Crypto |

Settlement Price < Knockout Price |

Buy the desired token at the preset Purchase Price |

|

Knockout |

Settlement Price ≥ Knockout Price |

Receive your principal plus yield in USDT |

Scenario 1: Settlement Price < Knockout Price

At maturity, if the Settlement Price is below the Knockout Price, you will be able to purchase your desired token at the preset discounted Purchase Price.

Scenario 2: Settlement Price ≥ Knockout Price

At maturity, if the Settlement Price is at or above the Knockout Price, the crypto purchase will not be triggered. You will receive your principal together with the APR yield in USDT. The yield is calculated as follows:

Yield = Principal × APR ÷ 365 × Duration

Example

Trader A invests 10,000 USDT in BTC via Discount Buy.

-

Current BTC Price: 30,500 USDT

-

Investment Duration: 1 day

-

Purchase Price: 29,900 USDT

-

Knockout Price: 31,000 USDT

-

Knockout APR: 8%

Scenario 1: Buy Crypto

If the Settlement Price is 30,800 USDT, which is below the Knockout Price of 31,000 USDT, Trader A will receive approximately 0.334448 BTC (10,000 USDT ÷ 29,900 USDT) at settlement.

Scenario 2: Knockout

If the Settlement Price is 32,000 USDT, which is above the Knockout Price of 31,000 USDT, Trader A will receive the initial investment plus USDT yield. The total return is:

10,000 + (10,000 × 8% × 1 ÷ 365) ≈ 10,002.19 USDT

MNT Products

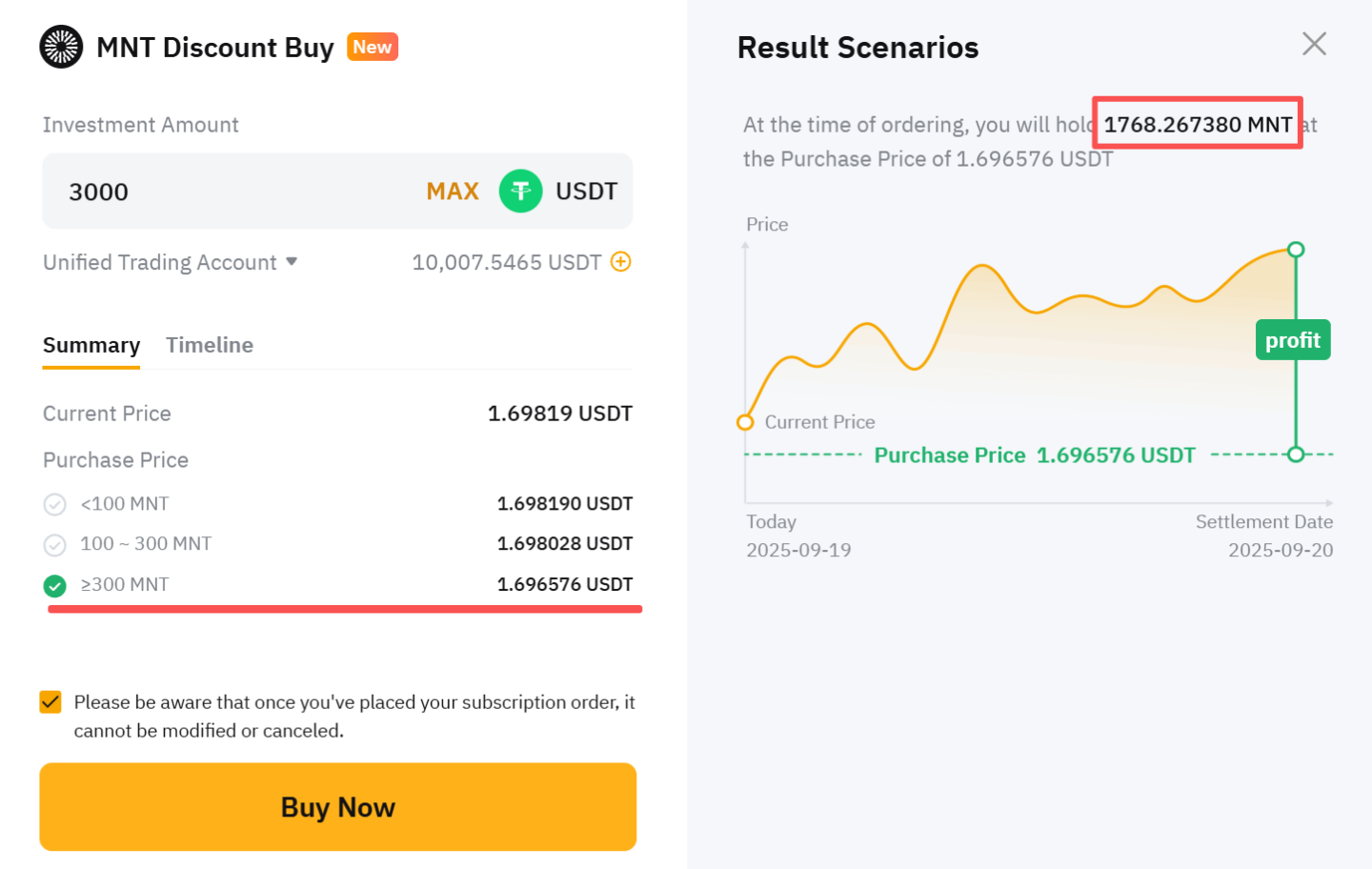

When you subscribe to MNT Discount Buy, your funds are immediately locked as MNT holdings. During the lock-up period, your holdings are calculated in MNT, and you can enjoy all MNT holder benefits, including the MNT multiplier for VIP upgrades.

This product has no target price or knockout limit. You will always buy MNT at your preset Purchase Price at maturity, regardless of market fluctuations. The larger the purchase amount and the longer the lock-up period, the greater the discount.

Example

Trader B invests 3,000 USDT in MNT via Discount Buy.

-

Current MNT Price: 1.698190 USDT

-

Investment Duration: 1 day

-

Preset Purchase Price: 1.696576 USDT

Regardless of the Settlement Price, Trader B will purchase MNT at 1.696576 USDT on the settlement date, receiving approximately 1,768.267380 MNT (3,000 ÷ 1.696576). Trader B will enjoy all MNT holding benefits from the 1,768.267380 MNT immediately upon subscription. The MNT assets will be available for use after a 1-day lock-up period.

Notes:

— The figures shown are for illustrative purposes only.

— Although the preset Purchase Price is lower than the market price at the time of order placement, it may still be higher than the Settlement Price at maturity if the asset price drops sharply. In such cases, the purchase is settled at the preset Purchase Price, which could result in a loss.

To learn more about Discount Buy, refer to the following articles: